Extraterritorial Compliance and Small Business

I’m a tiny business selling physical products through a web store to a global audience. I face a pile of business-related regulatory compliance requirements from my local city, county, state, and national government. A recent trend has seen the unwelcome addition of new compliance requirements from states and countries where I don’t live and don’t have any physical business assets – extraterritorial laws and regulations designed to reach beyond the borders of the governments that created them. While most of these regulations are well-meaning, there’s a very large combined burden from regulations from dozens of states and countries around the world where customers exist. For a small business, it means ever more time spent pushing paper, and less time focused on the core business and product development. Ultimately it could force the difficult choice to stop serving customers outside the home area.

Extraterritorial Regulations Background

For many US-based businesses, the European GDPR regulations were their first experience with an extraterritorial law. This EU regulation is mostly responsible for the proliferation of “cookie warnings” we see on virtually every web site today, regardless of whether the site’s owner is located in the EU. In this case, the EU asserts jurisdiction over companies anywhere that may interact with EU citizens on the web. Unless the web site uses geolocation to block visitors from Europe, this means GDPR is effectively a global regulation.

How are these extraterritorial laws enforced? The EU doesn’t have any legal jurisdiction over people outside its borders, and no standard way to enforce its extraterritorial regulations. Enforcement relies on the high amount of international business interconnections in today’s world. Non-EU companies that violate GDPR may have their EU-based shipments and assets seized, or they may be ostracized by forbidding EU companies from doing business with them. Only the most insular companies can afford to ignore such threats.

Just in case it’s not clear, I’m not a huge fan of extraterritorial regulations. They not only make BMOW’s operations more difficult, but they subject people to regulations where they had no representation in the decision making. But I do acknowledge something is needed to craft sensible laws in a cloud-based world where location can be a fuzzy concept.

EU Requirements

From BMOW’s viewpoint, many of these externally-imposed regulations are coming from the EU.

LUCID is an obligatory packaging requirement. As best as I can understand, it exists in many EU countries but the enforcement effort is from Germany. All companies, wherever they’re located, are required to register themselves with the LUCID authorities and declare their annual weight of shipped packages. Then they must purchase a packaging license from a third party. The cost of this license is intended to offset the cost of disposing of or recycling the packaging from shipments, and it depends on the type of packaging used (for example paper versus plastic) as well as the total amount. The goal is to encourage companies to use more environmentally-friendly packaging options, which is laudable. But for businesses outside the EU, the implementation is onerous and it creates an extra hoop that must be jumped through for every international sale.

Language and product support requirements for other countries have also been a challenge and a source of confusion. I once had a shipment rejected by the German customs authority for reasons that weren’t immediately clear. After speaking with the customer, who spoke with the customs inspector, I was informed that I needed to provide German language product documentation and an in-country representative to handle product concerns. The customer didn’t get their package, and I had to apologize and give a refund. I’d never heard of that requirement before, nor has it come up again since then.

Another potential source of externally-imposed regulation is the GDPR. Beyond the actual privacy requirements that were already mentioned, businesses that do not have a physical presence in any EU country may need to have a physical representative located inside the region to comply with the GDPR.

Sales Tax Collection

Tax collection is the most visible area where other states and countries impose requirements on businesses outside their borders. For internet-based sellers in the USA, it used to be common practice to collect sales tax from customers located in the same state as the business, and everyone else got tax-free purchases. If a customer in New York bought something from an internet merchant in California, the customer was supposed to file and pay a New York use tax return, but in reality zero people did this and New York would just lose the tax revenue. In recent years the states have been much more aggressive about pursuing sales tax from out-of-state business, based on confusing requirements about economic nexus. For sales within the USA, businesses may have to collect sales (at varying location-based rates) and submit separate sales tax returns to up to 45 different states, individually.

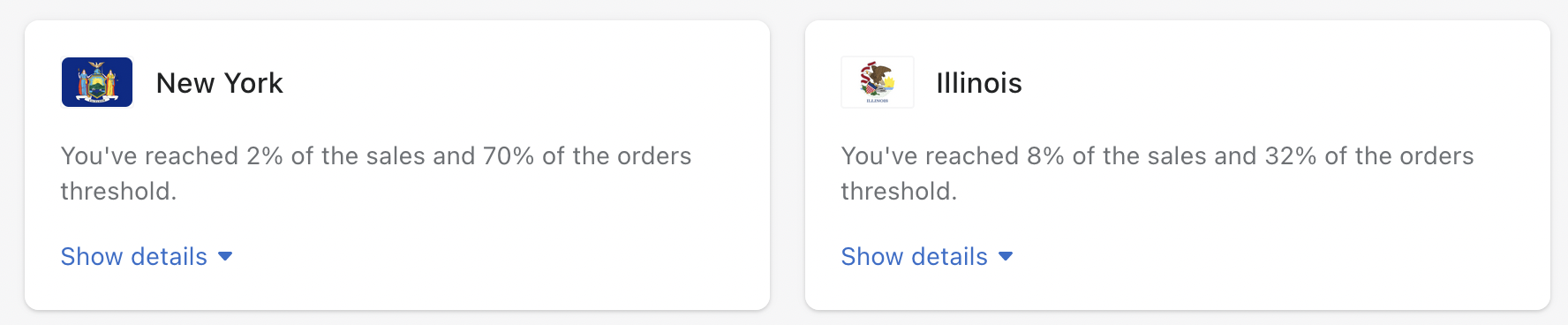

Most states now apply a sales threshold beyond which out-of-state sellers are required to collect and report sales tax, even if they don’t have a physical presence in the state. Some e-commerce platforms like Shopify will track these thresholds for you. Here’s some of mine:

Unfortunately the automated tracking of a sales threshold is a completely different animal from actually registering with a state’s tax authority and filing a quarterly sales tax return. California’s sales tax return already requires several hours of my time four times per year, and I don’t relish the thought of adding returns in New York and Illinois and 42 other states. I’m undecided about what I’ll do when that New York threshold reaches 100 percent. Cutting off sales to customers in New York isn’t a fun prospect, but neither is adding more compliance paperwork to an already full pile.

VAT Collection

Just as New York and Illinois are eager to get sales tax when their residents buy something from my California business, France and Germany are eager to get VAT when their residents buy something from my USA business. Now it’s called VAT instead of sales tax, but it’s the same concept and it extends the potential tax collection and reporting burden from 45 US states to every nation in the world.

Currently it’s the EU and Canada at the forefront of international VAT collection efforts. And unlike for out-of-state US sales tax, there’s generally no sales threshold and no minimum purchase amount below which small businesses can take shelter. EU countries require that non-EU businesses collect and submit VAT beginning with their very first sale, for any amount of dollars or euros. It’s totally understandable that these countries want to recoup the lost VAT revenue, but it puts a huge amount of extra compliance burden on small businesses. The idea of registering with tax authorities in Belgium, collecting per-customer VAT payments, and submitting periodic European tax returns and reports… for me, as a company with no EU business presence, that’s simply a bridge too far.

Fortunately there’s an alternative that works for now. BMOW can send shipments to the EU and Canada without any VAT, and the authorities in those countries will collect the VAT directly from the customer before delivering the shipment. It sounds great, except it creates some extra delays and costs for customers in those locations. Even when everything goes as expected, it’s a cumbersome process where the package gets stored in a warehouse while the shipper sends a notice to the customer, asking for the payment of VAT plus an additional brokerage fee. The customer may be able to pay online, or may need to physically visit a post office or shipping office. Once the VAT is paid, the package gets released for final delivery to the customer’s door. But if there’s a hiccup in the process, the customer never gets notified that their package is awaiting VAT payment. It languishes in a warehouse for weeks until it’s finally returned to sender by the slowest possible method, arriving back at my address six months or a year later.

So What?

There’s a lot of regulation that impacts small businesses, and much of it from external authorities, but so what? I expect this essay may attract some negative comments and a story on Hacker News titled Small Business Snowflake Thinks Laws Shouldn’t Apply to Him. They’ll say “If you don’t like the laws in (wherever), then don’t serve customers there!” Quite right. And that’s exactly the decision I’m facing now.

I’m realistic. The tax man needs to get paid, and can’t allow buyers to escape paying tax by purchasing everything out-of-state or out-of-country. Governments need to be able to craft product environmental and safety laws that won’t be trivially circumvented by products coming from outside their borders. These are real problems.

But where does this leave a small business with a global reach, a 1.5-person show selling retrocomputer gadgets that were designed for fun? Every day I’m looking at the mounting pile of compliance requirements and paperwork coming from every corner of the globe, and wondering how I’ll ever find time for business and product development amid everything else. My local and state compliance requirements already include the city business license, state reseller permit and sales tax returns, income tax returns, liability insurance, worker’s comp, employment regulations, and more. It’s already a mountain of red tape, even before external jurisdictions begin to impose their own requirements on me.

Ultimately my hope is to pay somebody to handle most of this stuff, if it’s not prohibitively expensive. I don’t spend time stressing about payroll filings, because I use a payroll service. Maybe an accountant to handle the 50 different sales tax and VAT reports? For several of these requirements like LUCID and EU VAT, there already exist cottage industries of in-country agents that will assist foreign businesses. Shopify has some support for these things too, although they tend to be focused on collecting information and stop short of actually fulfilling the compliance obligations. When I researched them in the past, my eyes quickly glazed over with legalese and I failed to grasp the big picture of what exactly I’ll need to do. But with a bit of luck, I hope to reach the summit of this regulatory compliance mountain.

In my dream world, the US would have a single national sales tax system instead of countless separate state, county, and city tax fiefdoms. Then governments wouldn’t worry about losing revenue on out-of-state sales, while businesses would only have to cope with a single collection and reporting system, and everyone would benefit. In this dream world, countries would also work together at the UN or WTO to draft product requirements that applied consistently across the globe, instead of a hodge-podge of different requirements in every different country. Compliance and reporting requirements would also come with intelligent thresholds based on sales volume or business size, to ensure that the compliance burden was appropriate for the business size, and nobody was driven out of business due to overwhelming red tape. I can dream.

Read 7 comments and join the conversation7 Comments so far

Leave a reply. For customer support issues, please use the Customer Support link instead of writing comments.

I just started working at Stripe, which has a product called Stripe Tax to automate collecting VAT and sales taxes, and some of the remittance and registration burdens. I’m pretty sure Shopify even has an app so you can collect payments through Stripe without having to move your store.

Also, try talking to your Shopify account manager to see if they already have some other solutions for your international compliance problems! They are always happy to sell you more stuff 😀

Or at least they’ll share your feedback to their internal product teams.

Let’s face it Steve, they really don’t like small businesses. That’s the only conclusion I can come to with all of this.

I wish I had any kind of an answer for you, but I don’t. Good Luck with whatever you decide.

Ouch…I feel bad for you, first supply chain issues, and now this. 🙁

How does ebay handle things? I only sell occasional random things, not a big-time seller by any stretch, but I have sold two or three things now that went out via their “Global Shipping Program”. I ship it off to a provided address in the USA, and then they take care of getting it on to its final destination. Not sure if it might be different from used/old/vintage items like I sell vs. setting up a storefront and selling new items via ebay? Of course the down-side is going to be presumably higher fees, but maybe that is still less expensive than dealing with other options?

eBay sellers are required to comply with LUCID just like everybody else. They can’t automatically do it for you. There’s some info about it here: https://www.ebay.com/help/selling/extended-producer-responsibility-business-sellers/german-packaging-act-business-sellers?id=5336

I think a lot of this stuff is selectively enforced, and up to the discretion of the customs inspectors and postal system staff.

The picture above shows the following stickers made by the local postal service (“Deutsche Post”) in Germany:

The yellow one is a base warning for the last mail carrier to collect some value (seen in the green one).

The green one says, to collect EUR18.52 customs from the recipient (the recipient usually knows that this could happen).

The white one, with the “R” label (“registered letter”) says, the package has been notified to be picked up (at the adress given on it).

The pink one marked the text “non reclamé”, which means, the package was not picked up by the recipient at the post office, so it has been sent back.

This posting has been made with kind regards from…

Germany 😉

I’m sorry to hear of your problems. As a very new user of your products I hope you can work something out.

The truth is that e-commerce royally blindsided states. When every business (well most businesses) were conventional brick and mortar and inside the state’s borders, there wasn’t a serious threat to the revenue streams from state sales and vat. They were losing an important revenue stream, and they are just trying to “circle the wagons.” Parts shortages are affecting every industry, but the tech sector and those who use it are suffering. Last time I got my car serviced at the dealer, I found some cars on the lot for sale, but looking closer almost all of them with a couple exceptions were used vehicles. Yikes! All due to chip shortages.I hope you can ride this out. I needed a replacement chip for a board and I wound up going to a Chinese source. None of the usual vendors had any.

Chris

It’s 2024, we ALL have a stupid amount of reach and communication ability now… but our laws and regulations are still apparently stuck in the 1960s. It’s ridiculous. Especially considering that megacorporations basically strongarm what changes happen regarding commerce laws. Of COURSE a small business would suffer compared to megagiants like Amazon and whatever. And THEY have the funds to accommodate for the bullshit they created.

I’d like to punch Hackernews in the throat if you can’t tell.